Information for Vendors

PEMCO works with vendors who share our commitment to the communities we support – through quality of products and services, operational strength, fiscal responsibility, ethical practices and positive community presence.

Vendor setup

All U.S. claims vendors are required to complete a W-9 form before payment can be made. Information collected on the W-9 facilitates accurate 1099 IRS reporting.

If you will be providing goods or services on a PEMCO claim, please send us a typewritten W-9 or complete a PEMCO Substitute W-9. For faster processing, submit an electronic version of the form. Please include the claim number.

- Send your completed form to payee.codes@pemco.com or fax it to 206‑676‑7160.

- You can also mail it to PEMCO, P.O. Box 778, Seattle, WA 98111-0778.

If you need to make any changes to your information on file with us, please send in a new W-9 or submit an updated PEMCO Substitute W-9.

Information for foreign vendors

If you are a foreign (non-USA) vendor, the W-8BEN (for individuals) or the W-8BEN-E (for entities) must be completed.

- Send your completed form to payee.codes@pemco.com or fax it to 206‑676‑7160.

- You can also mail it to PEMCO, P.O. Box 778, Seattle, WA 98111-0778.

For more information about these forms and requirements, please visit the Internal Revenue Service website.

Want to receive your payments electronically?

PEMCO has electronic funds transfer (EFT) capability to expedite claims payment processing. Once payment is issued, it may take 48-72 hours for the payment to process. You will receive an explanation of benefits with the details of the payment (including the customer name, invoice number and other claim details).

If you are already set up as a vendor with PEMCO, fill out an EFT Authorization Agreement and return it via the instructions on the bottom of the form.

If you have not yet submitted a W-9 or PEMCO Substitute W-9, please return to the Vendor Setup section above and follow the instructions.

Currently we cannot process EFT requests for foreign funds.

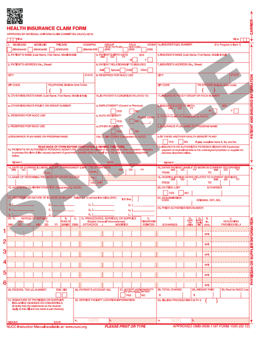

Submitting medical bills to PEMCO

The following guidelines will help expedite payment of your medical bills:

- Submit your medical bills on the standardized, red versions of the CMS “HCFA” 1500 (02-12) or UB-04 billing forms when possible. Hand-written bills or black and white copies of the forms may require additional processing.

- Include a valid, 11-digit PEMCO claim number in box 1a. or 11. on the CMS 1500 or box 60. or 62. on the UB-04.

- Key entries in black ink and within the confines of each data field.

- Avoid writing on or highlighting data fields.

- Include the chart notes associated with the date(s) of service you are seeking payment.

Mail all bills to PEMCO at P.O. Box 4384, Clinton, IA, 52733. Medical bills and records may also be submitted by fax to 206-268-2715 or by email at medical.bills@pemco.com with the 11-digit PEMCO claim number in the subject line.

If you have questions about medical bills you have submitted for payment or to obtain the claim number for your patient, please contact the assigned adjuster or call customer service at 1‑800‑467‑3626.

Questions?

Contact us:Email: payee.codes@pemco.com

Fax: 206-676-7160

Mailing address: PEMCO, P.O. Box 778, Seattle, WA 98111-0778

PEMCO works with vendors who share our values, and our commitment to the communities we support – through quality of products and services, operational strength and fiscal responsibility, and with those who demonstrate pride in ethics and community presence.

Contact us

All invoices should be emailed direct to PEMCO-AP@pemco.com

You can contact Purchasing at Purchasing@pemco.com

You can contact Accounts Payable at accounts.payable@pemco.com